What's going on with energy prices in 2023?

In the past 18 months, the level of volatility in the energy market has been unprecedented. The price of gas started rising in 2021, when several issues including low wind generation, power station outages and delays to Nord Stream 2 combined in a perfect storm that led to 31 suppliers sadly exiting the energy market. Russia’s invasion of Ukraine in February 2022 caused wholesale prices to soar further up to a high of £1000/MWh, due to a huge level of concern over Russian supply, particularly in regards to how Europe would cope in the cold winter months.

But what has happened since then? What impact has this had on businesses? And what factors might influence the cost of energy this year? We explain all in this article.

How volatile have gas prices been?

Gas is traded in pence. Before the pandemic, movement in prices by just one pence was quite a big deal and reflected a level of volatility in the market.

Back in spring and summer 2022, when Europe was stocking up on gas ahead of an unknown winter, the prices of gas were moving by up to £1 a day. These daily fluctuations have settled to around 1-5p per day again – mainly due to countries de-risking themselves from Russian supply and having plenty of gas remaining in storage after a mostly mild winter.

What happened with energy prices last winter?

When Russia invaded Ukraine, there was a lot of uncertainty about whether Europe would have enough gas for the winter. Energy suppliers like us needed to pre-buy enough electricity and gas for our customers to see us through the winter; and the EU warned that gas storage levels across Europe should be kept at a certain level which led to lots of expensive shipments of LNG from America and gas via pipeline from Norway. Between September and November 2022, when storage levels were high, the price of gas lost more than half of its value in a matter of months. A very cold spell in early December caused prices to rise again, but this settled down around Christmas as the temperatures got warmer and much of industry shut down for the festive period.

Apart from a few cold periods, January and February 2023 has been unseasonably warm. In addition, due to the huge rises in cost of living across Europe, demand levels have been around 85% – 90% of what was expected as people have not been using their heating as much. This means that there are still good levels of gas in storage as we move into spring.

What factors might influence energy prices this year?

At the moment, wholesale energy prices have fallen from their peak, and are more stable than they were. They could still go up if supply infrastructure were to break, or something else were to happen geopolitically; or they could continue coming down. Here are some of the factors that might influence prices over spring and summer:

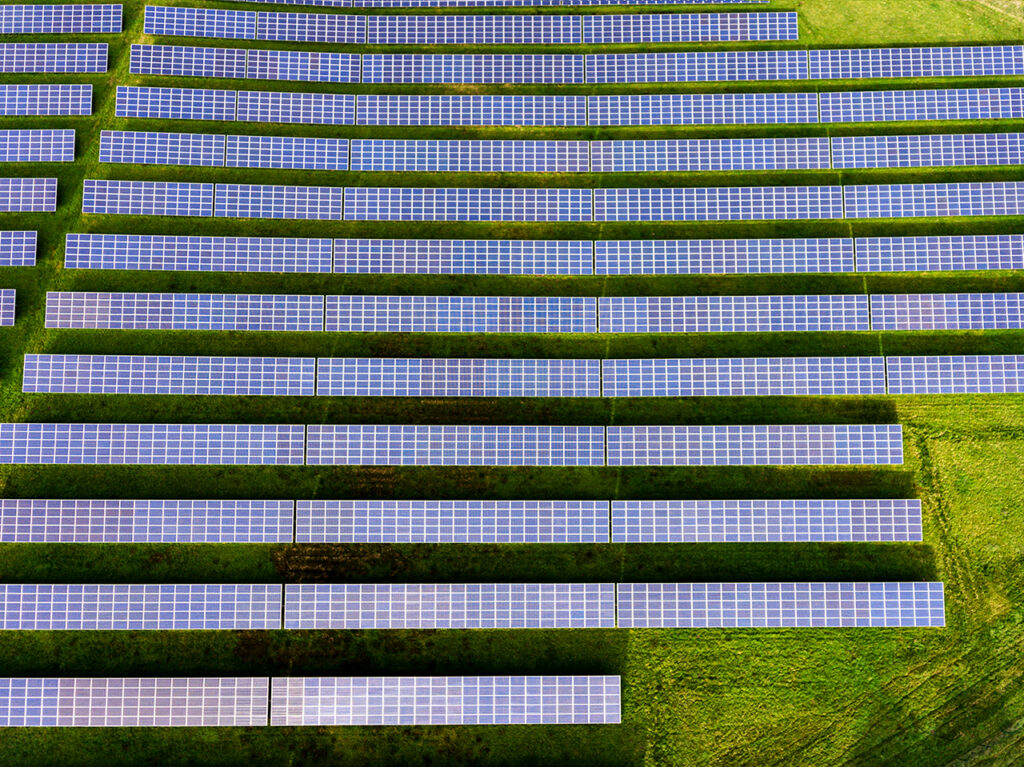

Renewables: In the summer, the amount of wind and solar generation has a big impact on prices. On sunny days, you can see demand for power go very low – this is because of embedded generation where households and businesses are generating and using their own power rather than drawing electricity from the grid. But last summer for example, although it was very hot, was also very still. This led to the UK using more coal and gas than expected to generate electricity, which is more expensive than wind power.

Storage: If gas storage levels across the EU remain quite full, they may not need to be replenished in the same way as last summer. But if more gas than expected is used to generate electricity, these levels might need to be topped up ahead of the winter.

Where the gas comes from: Over the past year, we have been getting a lot of LNG from the USA via shipment. However, it will only come to the UK and Europe if we are willing to pay the highest price. So if other markets, in particular Asia, increase their gas demand – which often happens if there’s a warm summer – shipments will go there and not to Europe. The UK would therefore need to rely more on its own gas and imports from Europe, which is typically more expensive.

Infrastructure: Over the last few months nuclear reactors in France have been slowly returning to production after being turned off or down. France exports a lot of its cheaper electricity to the UK when there’s a surplus of generation, but due to the nature of France’s aging nuclear fleet, concerns over the amount of electricity they might generate going forward have seen electricity prices across Europe rise. Were this surplus to stop, the UK would be without this cheaper generation; and if they dropped considerably, the UK would likely start exporting electricity to France, leaving us with even less electricity.

Geopolitical problems: The energy market is very tied to geopolitical unrest. The recent one year anniversary of the Ukraine war serves as a reminder that geopolitical tensions remain.

What can businesses do to protect themselves from high prices?

The energy crisis has really exposed the UK’s reliance on imported gas. It has also put a spotlight onto the energy industry, with pressure being put onto the government and the National Grid to show that this level of crisis won’t happen again. As a country, as businesses and as individuals, we can all do something to reduce our energy demand and to increase the percentage of our electricity that is generated by renewables.

Is this the year you invest in renewable generation or battery storage at your business’s premises? Could you shift certain operations to off peak times to benefit from cheaper electricity prices? Or are there some energy efficiency measures you could make, like upgrading equipment or improving your insulation?

Good Energy installs solar panels through Wessex ECOEnergy, an established solar panel installer that became part of Good Energy Group in 2023. Wessex is based in Dorset and is MCS, RECC and Tesla Energy Certified, with a strong reputation for high-quality service and installation standards.

Investing in solar and battery storage can hugely reduce what you draw from the grid, as well as providing a potential new revenue stream if you generate more than you can use. Solar installers advise that businesses and households could expect a return on the cost in as little as 3-5 years, although this depends on various factors.